CEGEAC

member of JPA International

Audit, Expert Accountancy, Consulting

Le Cannet

Cannes

Alpes-Maritimes

Audit, Expert Accountancy, Consulting

Le Cannet

Cannes

Alpes-Maritimes

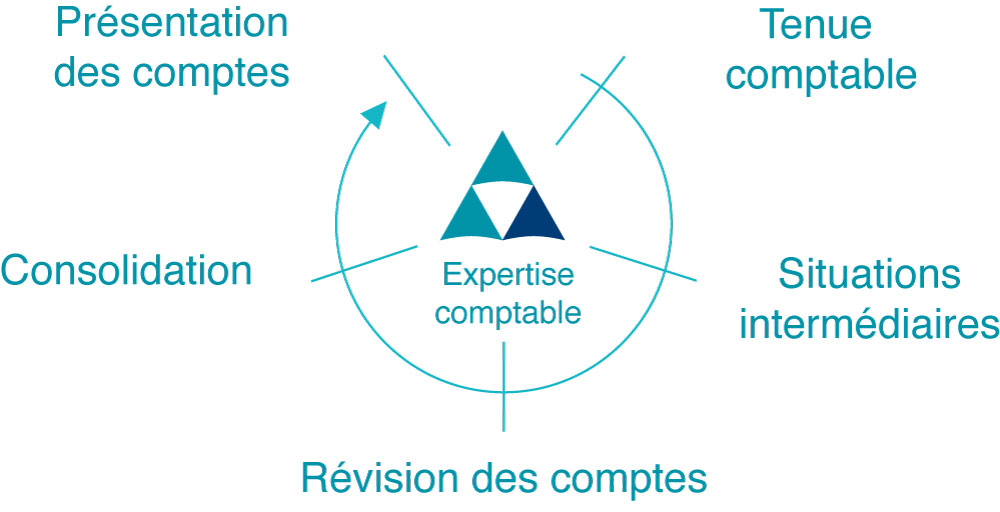

Setting up and organisation of general accounting.

Setting up and organisation of specific accounting (analytical, multi-currency).

Drafting of administrative and internal control procedures.

Assistance during inspections of the External Auditor.

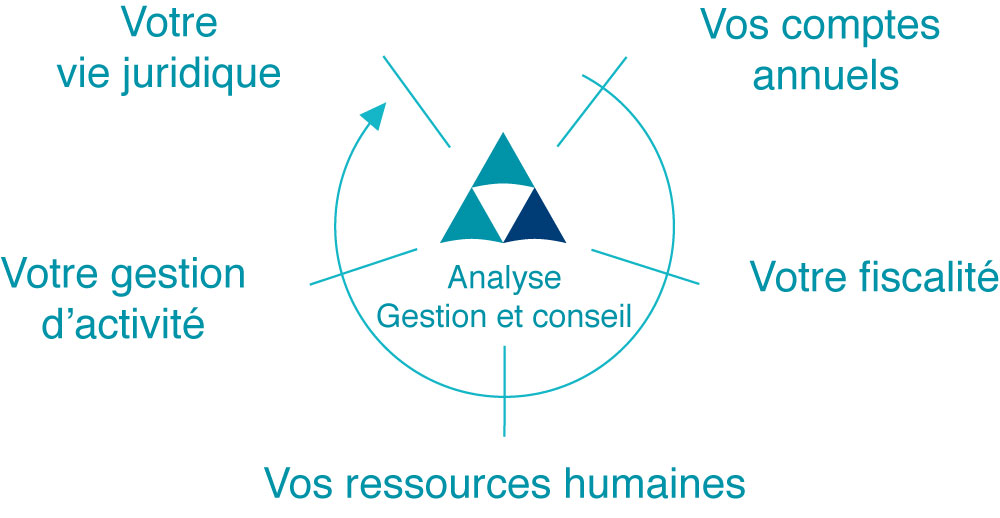

At every stage in the life of your business,

we take into account the interdependence of your problems .

in order to jointly construct global solutions adapted to your situation :

Professionals :

At each stage of your company's life, from its creation to its transfer and throughout its development, we will advise you on the most appropriate personalised solutions for your situation through :

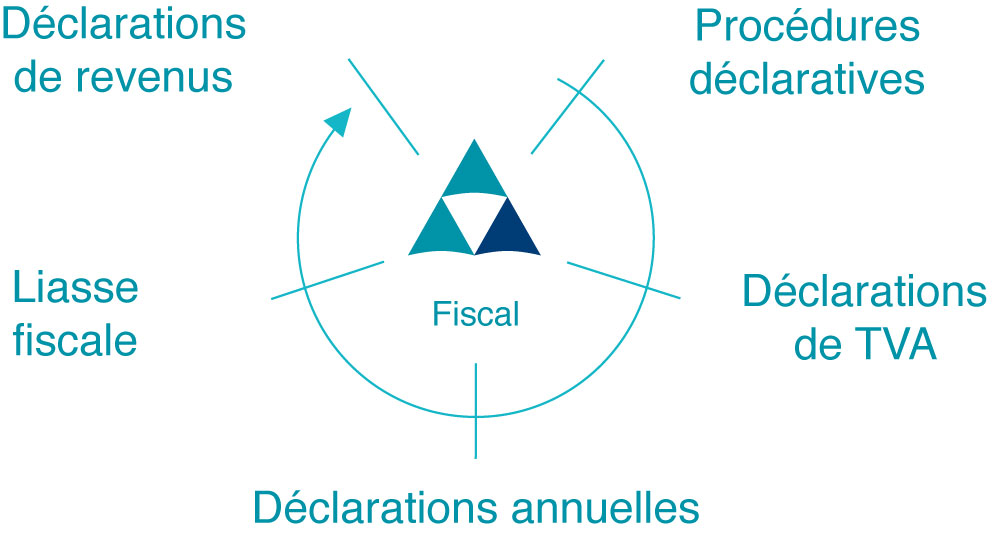

• The implementation and monitoring of a tax strategy by offering you the most relevant tax options..

• Monitoring of this strategy on a daily basis according to changes in your company and legislation.

• The preparation of all professional tax declarations.

In the constant search to make your life easier and relieve you of tedious tasks.

• The systematic use of remote declarations and remote payments.

• The provision of our secure Extranet where you will be able to access all your tax documents 24 hours a day, 7 days a week.

• Relations with the tax authorities, approved management centres and associations.

• Assistance during tax audits.

Individuals :

Our team is at your service to assist you and advise you in your personal taxation regarding :

• The implementation and monitoring of a tax strategy by offering you the tax options best suited to your situation and any changes envisage.

• Income tax.

• Real estate wealth tax.

• Tax exemption.

• Assistance in the event of a tax audit.

• Preparation and support for transfer

We offer you five tax simulation tools :

• Income Tax bands chart: Based on your family situation, determine the applicable tax rate per income band.

• Family Quotient: Determine your Family Quotient based on your personal situation.

• Income Tax Flash: calculate your tax amount.

• Dividend Option: optimise the taxation of your dividends (single flat-rate withholding tax or progressive scale).

• Real Estate Wealth Tax Flash: calculate the amount of your Real Estate Wealth Tax.

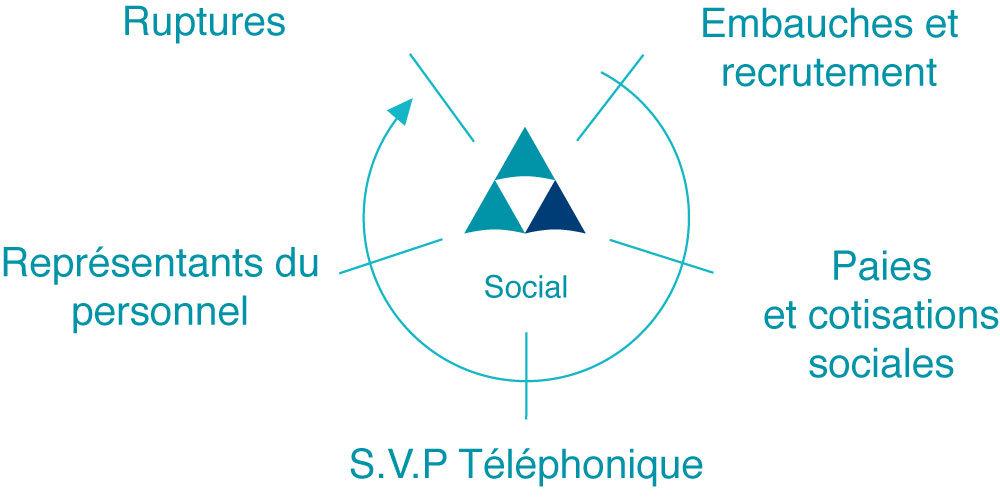

Assistance in setting up employee savings schemes :

Assistance and advice on labour legislation.

Human resources strategy: assistance in optimising the management of jobs and skills.

Setting up an organisation chart.

Job definition.

Social audit.

Assistance with URSSAF controls (Social Security contribution collection agency).

Assistance in litigation matters.